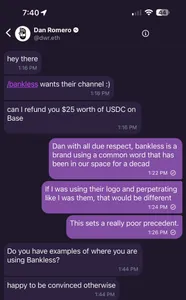

One of the promises made by proponents of crypto-focused decentralized social networks like Farcaster is that you can't be de-platformed by centralized companies, and you maintain control over your own presence on these platforms.This made it a bit of a shock when the co-founder of the a16z-backed Farcaster blockchain-based social network messaged a user to inform them that he would be taking away the channel name he had registered, whether he agreed to it or not. According to the co-founder, Dan Romero, the popular Bankless crypto podcast had requested the bankless channel name, which the user he was messaging had already registered.

After the user argued back against Romero's offer of $25 in USDC to reimburse him for the channel name, and said it set a poor precedent, Romero stated: "ok this isn't productive. do you want USDC for the refund or warps" (referring to the non-crypto points used by the Warpcast client for Farcaster).

On one hand, some criticized the user who had registered the name for allegedly squatting on the channel name and trying to resell it. Romero defended his decision by arguing, "I never said channels were decentralized yet" (though the platform does generally claim to be "sufficiently decentralized"). Others argued the action set a bad precedent, and flew in the face of the ethos supposedly motivating these types of web3 social networks.

Romero has promised on Twitter that Farcaster channels "will be onchain later this year and like [user identifiers] won't be able to be touched." When pushed on the precedent this sets, he replied, "So let the squatter extort money?" Romero clearly needs to grapple with the fact that, like it or not, squatting is a feature of systems that take a hands-off approach to managing access to identifiers. This should not be news to anyone remotely familiar with the web, where "domaining" emerged out of the relatively laissez-faire structure of DNS — though unlike with fully decentralized identifiers, there can be some intervention when domain name speculation enters the realm of cybersquatting.