The stolen tokens were notionally priced at around $5.14 million, although the sale of the stolen tokens resulted in a price drop that meant the attacker ultimately was only able to trade them for 1,629 ETH (~$4.5 million). The BEAM price dropped around 10%.

Trader loses $4.5 million in phishing attack

YouTuber KSI accused of pump-and-dump

Although the token dumping occurred in March 2022, zachxbt waited until now — when KSI returned to his dormant Twitter account — to release the evidence he'd collected.

KSI had previously claimed to followers that he was "holding his bags", meaning not selling the XCAD tokens he'd purchased or been given. zachxbt determined this to have been a lie. The XCAD founder later came to KSI's defense, claiming he had bought more tokens than he sold, as though that somehow justifies the behavior.

- "KSI Accidentally Exposes His Crypto Scams", Coffeezilla [archive]

- Tweet thread by zachxbt [archive]

"Decentralized" social network Farcaster criticized after confiscating channel name to be used by influential crypto podcasters

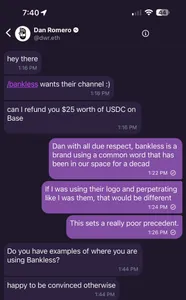

This made it a bit of a shock when the co-founder of the a16z-backed Farcaster blockchain-based social network messaged a user to inform them that he would be taking away the channel name he had registered, whether he agreed to it or not. According to the co-founder, Dan Romero, the popular Bankless crypto podcast had requested the bankless channel name, which the user he was messaging had already registered.

After the user argued back against Romero's offer of $25 in USDC to reimburse him for the channel name, and said it set a poor precedent, Romero stated: "ok this isn't productive. do you want USDC for the refund or warps" (referring to the non-crypto points used by the Warpcast client for Farcaster).

On one hand, some criticized the user who had registered the name for allegedly squatting on the channel name and trying to resell it. Romero defended his decision by arguing, "I never said channels were decentralized yet" (though the platform does generally claim to be "sufficiently decentralized"). Others argued the action set a bad precedent, and flew in the face of the ethos supposedly motivating these types of web3 social networks.

Romero has promised on Twitter that Farcaster channels "will be onchain later this year and like [user identifiers] won't be able to be touched." When pushed on the precedent this sets, he replied, "So let the squatter extort money?" Romero clearly needs to grapple with the fact that, like it or not, squatting is a feature of systems that take a hands-off approach to managing access to identifiers. This should not be news to anyone remotely familiar with the web, where "domaining" emerged out of the relatively laissez-faire structure of DNS — though unlike with fully decentralized identifiers, there can be some intervention when domain name speculation enters the realm of cybersquatting.

- "Farcaster" blog post by Dan Romero [archive]

- "Farcaster Explained: The Blockchain-Powered Decentralized Social Media Protocol", Decrypt [archive]

- Tweet thread by JohnnyFiat.eth [archive]

- Tweet by Dan Romero [archive]

- Tweet by Dan Romero [archive]

Creator of "Robotos" NFT project, once collaborating on a TV series with TIME studios, accused of rug pull

Rewind to November 2021, when it was announced that TIME Magazine's film and production studio would be collaborating with Stanley to develop a children's animated TV show based on the Robotos NFTs. The announcement helped to drive interest in the NFT collection, which reached a peak floor price of around 1.5 ETH (~$5,000 at the time).

Since then, no show has materialized, and the collection's floor price has dwindled. NFTs from the collection have recently sold for around 0.015 ETH (~$42). In the project Discord, Stanley claimed that TIME had lost interest in the project after the writer's strike. He also wrote that he had lost faith in web3: "Glad you still believe. It's hard for me to believe in it anymore." He explained that he had viewed Robotos as a "personal side project", and that he was "sorry if that's not enough for most people, but that's all I have the appetite for, and that's all I can offer."

- Tweet thread by HashBastardsNFT [archive]

- Tweet thread by Robotos [archive]

- Tweet by FotiWeb3 [archive]

- "TIME Studios, in Partnership with Nelvana, to Begin Production on Two Animated Children’s Series Based on New Characters from Creators of 'Robotos' and 'the littles' NFT Collections", press release from TIME [archive]

Duelbits crypto casino exploited for $4.6 million

It appears that the thief got access to a Duelbits wallet, perhaps through a private key compromise.

Yuga Labs bungles "free" Otherside NFT drop

Yuga released a new NFT, intending to function as ship parts that could be combined to create a ship to be used in the game. Players who had completed an Otherside minigame would be eligible to mint these NFTs for free. However, the "free" NFT cost around $30 in gas fees to mint. Worse still, the parts were meant to be repeatedly traded and combined to make new parts and ships, leading fans to wonder why on earth they decided to release the project on a blockchain where each transaction often costs tens of dollars.

Apparently realizing they'd made a mistake, Yuga first responded by announcing they would gift people free "Catalyst" NFTs to make it up to them. This only sparked further rage, though, as it was seen to dilute the value of the Catalyst NFTs and throw off incentives.

Yuga later reversed course on this decision, instead deciding to reimburse the gas fees.

This was not Yuga Labs' first gas-related fiasco, after they caused gas fees to spike into the thousands of dollars across the entire Ethereum network in April 2022 during the initial Otherside land sale.

One observer wrote, "[W]hat's the plan for the marketplace in Otherside that is supposed to support millions of daily microtransaction? I'm afraid this means Otherside is much less developed than we would like to hope. These decisions are entry level mistakes, not mistakes we should see from the biggest company in the space developing a metaverse. If the Otherside mint wasn't an eye opener, then this wont be either."

PlayDapp crypto gaming platform exploited, spurring misleading headlines

Days after the initial attack, on February 12, the attacker minted another 1.59 billion $PLA. This has led to news reports that the platform was exploited for "$290 million". However, this value is being naively calculated based on the token price without taking into account the massive supply inflation, and ignoring that that dollar figure is more than 2.5x the total claimed market cap of the token. Even reputable outlets like Bleeping Computer have printed the figure in their headline (though Bleeping Computer later changed the headline to a more accurate one).

PlayDapp sent on-chain messages to the attacker, offering a bounty, but the offer was ignored.

Solana goes down for five hours

With blockchains promising to become "world computers" upon which anyone can create projects ranging from mere toys to critical infrastructure, uptime is crucial, and a five-hour-long outage is devastating.

SIM swappers charged over hacks, reportedly including FTX

Although the indictment does not name FTX, Bloomberg has reported that "victim company-1" named in the court filings was FTX, which was hacked for around $400 million amid the chaos as the company was collapsing.

Crypto exchange created by Three Arrows Capital founders to shut down

Now, as Su Zhu emerges from several months in jail, he, Kyle Davies, and the other executives of OPNX are shutting down the project. Traders have a week to settle their positions, and another week before the platform closes entirely.

Both Zhu and Davies are, of course, trying to promote a new crypto derivatives trading project.