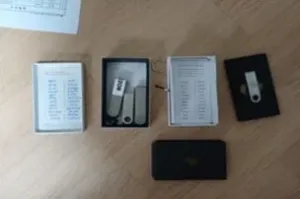

The blunder was likely due to the authorities' lack of knowledge about cryptocurrency. The move was somewhat akin to authorities publicly posting a username and password for a criminal's bank account — though that would likely be an easier mistake to unwind.

Crypto stolen from Korean authorities after they post wallet seed phrase

- "$4.8M in crypto stolen after Korean tax agency exposes wallet seed", Bleeping Computer [archive]

Step Finance, SolanaFloor, and Remora Markets shut down after January hack

According to Step Finance, "we explored every possible path forward, including financing and acquisition opportunities. Unfortunately, we were unable to secure a viable outcome and have made the difficult decision to end all operations effective immediately."

In reply to Step Finance's announcement, crypto investor Mike Dudas claimed that the project had contacted him about bridge financing, but that Step had never responded to his request for more information about the hack. "i responded: 'would need to see the security post mortem before i could consider investing here' <crickets>"

YieldBlox lending pool drained of $10.2 million

The attacker was able to manipulate the oracle price to show that USTRY was priced at $100 (rather than its actual trading price of around $1.05). Then, they borrowed against the overvalued asset, withdrawing XLM and USDC priced at $10.2 million. However, around 48 million of the stolen XLM (~$7.2 million) were frozen.

IoTeX bridge exploited for $2 million after private key compromise

Blockchain security researcher Specter has suggested there may be links between this attack and a $50 million theft from the Infini "stablecoin neobank" a year ago.

South Korean prosecutors lose $22 million of seized crypto to the wallet inspector, later recover it

On February 19, the office announced they had recovered the stolen assets and identified the thief.

Moonwell lending protocol suffers $1.78 million loss after second oracle misconfiguration in four months

This is the second time Moonwell has suffered a loss thanks to an oracle misconfiguration. In November 2025, the platform was left with almost $3.7 million in bad debt after a different asset was mispriced.

Although the vulnerable pull requests were at least partially developed by an AI tool, the security auditor who initially attributed the vulnerability to Claude Opus 4.6 later softened his criticism, noting that even senior developers could have made the same mistake. He did, however, criticize the project for a lack of sufficiently rigorous testing that should have caught the issue.

BlockFills crypto lender halts withdrawals

Platforms limiting or halting withdrawals — particularly lending platforms — is reminiscient of the 2022 crypto crash, when falling crypto prices exposed crypto firms that had been engaging in highly risky or sometimes illegal behavior. As crypto prices fell, firms were unable to meet their loan obligations or faced margin calls, and the tightly interconnected web of lending within the crypto ecosystem often meant that one company failure cascaded into multiple more. It remains to be seen whether this is an isolated incident or the beginning of a trend as crypto prices hit revisit price lows not seen in over a year.

BlockFills claims to have more than 2,000 institutional clients globally, and boasted of facilitating more than $61 billion in transactions in 2025. The company's backers include Susquehanna Capital and CME Ventures.

Bithumb accidentally gives away $44 billion to customers

The exchange announced that they had recovered 99.7% of the erroneously awarded tokens, leaving around 1,860 BTC (~$130 million) unaccounted for.

The incident has drawn further scrutiny from Korean regulators, who said that the error "has exposed the vulnerabilities and risks of virtual assets." Regulatory agencies in the country had already been cracking down on crypto firms following a $30 million hack of the Upbit crypto exchange in November 2025.

Gemini crypto exchange fires 25% of staff, blames AI

As many companies do these days, the Winklevosses tried to pin the layoffs on AI, claiming that the engineers using AI are ten times more productive. "A smaller organization, leveraging the right tools, isn't just more efficient, it's actually faster," they wrote — in a blog post that itself reeks of AI.

CrossCurve users exploited for around $3 million

CrossCurve took a conciliatory tone in on-chain messages sent to the thief, writing, "These tokens were wrongfully taken from users due to a smart contract exploit. We do not believe this was intentional on your part, and there is no indication of malicious intent." (Who among us hasn't accidentally stolen millions of dollars?) However, they warned, they planned to escalate to working with law enforcement and blockchain security firms to investigate and prosecute the theft if the funds were not returned within 72 hours.