Some were briefly concerned that Axie Infinity's Ronin Bridge had been hacked (again), since the funds moved out of the bridge. Jihoz and others were quick to emphasize that the bridge had not been affected, and it was simply a personal wallet compromise.

Axie Infinity co-founder suffers $9.5 million loss after wallet compromise

Influencer "Crypto Rover" accused of pump-and-dump and other shady behavior

Zachxbt outlined various incidents, including how Crypto Rover purchased "Stoned Pepe" tokens before posting to his hundreds of thousands of followers that he thought the token would "do at least a 10x", and claiming that he had inside info on the project. He also detailed how Rover had taken a $10,000 payment and 1% of the supply of a new token that he promised to promote, then never promoted — despite promising the team that he could "pump projects from 1/2m to 10m easy".

After zachxbt published his research, Rover deleted his Telegram channel.

Over $55 million taken from defunct AAX crypto exchange

Now, over a year later, the Cyvers blockchain security firm has observed more than 24,000 ETH (~$55.6 million) has been moved from wallets used by the platform. Although there could be innocuous explanations for money moving off a defunct platform, whoever was moving the funds used various decentralized services to launder the money, appearing to be trying to make it more difficult to trace.

Airdrop hunters spam Github projects

Several repositories for crypto projects that have not launched tokens were inundated with hundreds of trivial Github issues apparently written in the hopes that in the event of an airdrop, they would be considered contributions.

"Please don't submit a GitHub issue just for farming purposes," wrote one employee of a crypto project receiving such spammy contributions. "The [project] core team is stretched thin enough as it is, please don't make our lives harder." Several projects had to limit who was allowed to open new issues in their repositories to try to tackle the spam.

FixedFloat exchange hacked for $26 million

FixedFloat first wrote that they had "encountered some minor technical problems", then acknowledged that there had been a hack. FixedFloat is non-custodial, so no user funds were impacted, however some have reported frozen transactions and missing funds from using the service on social media.

- "FixedFloat confirms $26M exploit in Bitcoin, Ether", CoinTelegraph [archive]

Yuga Labs acquires Moonbirds amid speculation of insider trading

Anyway, after the acquisition was announced, prices for Moonbirds spiked, as was to be expected.

What wasn't expected was a notable spike in trading in the days leading up to the acquisition announcement, in which some wallets began accumulating large amounts of Moonbirds and related NFTs. One such wallet purchased 80 Moonbirds, 71 Moonbird Mythics, 28 Oddities, and 13 Mythic eggs in the week leading up to the announcement, and enjoyed several hundred thousand dollars in profits after the acquisition was announced.

Trader loses $4.5 million in phishing attack

The stolen tokens were notionally priced at around $5.14 million, although the sale of the stolen tokens resulted in a price drop that meant the attacker ultimately was only able to trade them for 1,629 ETH (~$4.5 million). The BEAM price dropped around 10%.

YouTuber KSI accused of pump-and-dump

Although the token dumping occurred in March 2022, zachxbt waited until now — when KSI returned to his dormant Twitter account — to release the evidence he'd collected.

KSI had previously claimed to followers that he was "holding his bags", meaning not selling the XCAD tokens he'd purchased or been given. zachxbt determined this to have been a lie. The XCAD founder later came to KSI's defense, claiming he had bought more tokens than he sold, as though that somehow justifies the behavior.

- "KSI Accidentally Exposes His Crypto Scams", Coffeezilla [archive]

- Tweet thread by zachxbt [archive]

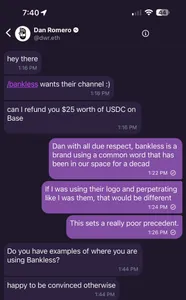

"Decentralized" social network Farcaster criticized after confiscating channel name to be used by influential crypto podcasters

This made it a bit of a shock when the co-founder of the a16z-backed Farcaster blockchain-based social network messaged a user to inform them that he would be taking away the channel name he had registered, whether he agreed to it or not. According to the co-founder, Dan Romero, the popular Bankless crypto podcast had requested the bankless channel name, which the user he was messaging had already registered.

After the user argued back against Romero's offer of $25 in USDC to reimburse him for the channel name, and said it set a poor precedent, Romero stated: "ok this isn't productive. do you want USDC for the refund or warps" (referring to the non-crypto points used by the Warpcast client for Farcaster).

On one hand, some criticized the user who had registered the name for allegedly squatting on the channel name and trying to resell it. Romero defended his decision by arguing, "I never said channels were decentralized yet" (though the platform does generally claim to be "sufficiently decentralized"). Others argued the action set a bad precedent, and flew in the face of the ethos supposedly motivating these types of web3 social networks.

Romero has promised on Twitter that Farcaster channels "will be onchain later this year and like [user identifiers] won't be able to be touched." When pushed on the precedent this sets, he replied, "So let the squatter extort money?" Romero clearly needs to grapple with the fact that, like it or not, squatting is a feature of systems that take a hands-off approach to managing access to identifiers. This should not be news to anyone remotely familiar with the web, where "domaining" emerged out of the relatively laissez-faire structure of DNS — though unlike with fully decentralized identifiers, there can be some intervention when domain name speculation enters the realm of cybersquatting.

- "Farcaster" blog post by Dan Romero [archive]

- "Farcaster Explained: The Blockchain-Powered Decentralized Social Media Protocol", Decrypt [archive]

- Tweet thread by JohnnyFiat.eth [archive]

- Tweet by Dan Romero [archive]

- Tweet by Dan Romero [archive]

Creator of "Robotos" NFT project, once collaborating on a TV series with TIME studios, accused of rug pull

Rewind to November 2021, when it was announced that TIME Magazine's film and production studio would be collaborating with Stanley to develop a children's animated TV show based on the Robotos NFTs. The announcement helped to drive interest in the NFT collection, which reached a peak floor price of around 1.5 ETH (~$5,000 at the time).

Since then, no show has materialized, and the collection's floor price has dwindled. NFTs from the collection have recently sold for around 0.015 ETH (~$42). In the project Discord, Stanley claimed that TIME had lost interest in the project after the writer's strike. He also wrote that he had lost faith in web3: "Glad you still believe. It's hard for me to believe in it anymore." He explained that he had viewed Robotos as a "personal side project", and that he was "sorry if that's not enough for most people, but that's all I have the appetite for, and that's all I can offer."

- Tweet thread by HashBastardsNFT [archive]

- Tweet thread by Robotos [archive]

- Tweet by FotiWeb3 [archive]

- "TIME Studios, in Partnership with Nelvana, to Begin Production on Two Animated Children’s Series Based on New Characters from Creators of 'Robotos' and 'the littles' NFT Collections", press release from TIME [archive]