UniLend acknowledged the hack, downplaying it as affecting "only" 4% of the platform's $4.7 million TVL. They offered a bounty to the attacker.

UniLend exploited for almost $200,000

Bankless hosts slammed for dumping tokens

Shortly after the token's public launch, Bankless VC dumped 300,000 AICC (8% of their allocation) for 344 SOL ($65,300). By immediately dumping tokens on retail when the token opened for public trading, they were able to sell the tokens for an average of $0.22 — considerably higher than the $0.05 to $0.11 the token has been trading at over the last 24 hours.

When questioned about the trades, Bankless host David Hoffmann wrote: "Agree that Bankless Ventures should not be selling tokens - that was an impulsive mistake." He announced that they had repurchased the tokens they had sold, and were "discussing a self-imposed vesting schedule" for selling tokens that they themselves had promoted.

They later posted a long apology in their Discord, blaming the sales on Ben Lakoff, a general partner of Bankless VC. "Ben did not have context for this, and was in the mindset of trading a local high as you might trade a meme coin you're bullish on - or there's no way he would have done this - huge mistake, first time something like this has happened - he's devastated", explained Bankless co-host Ryan Sean Adams. He also placed some blame on AICC for not imposing any token lockups or vesting schedule that would prohibit early investors from dumping tokens on retail.

- Tweet by David Hoffman [archive]

- Tweet by David Hoffman, with Discord post by Ryan Sean Adams [archive]

- AICC investor token sales [archive]

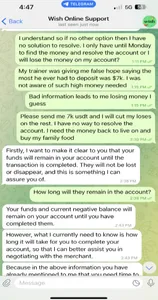

$2.2 million stolen by fake job scammers

One single victim was defrauded out of more than $100,000.

The NYAG has seized $2.2 million in Tether, and is pursuing legal action against the as-yet-unidentified scammers. Because of the unknown identities of the defendants, the NYAG will serve notice of the lawsuit via NFT — something they describe as a first by government regulators.

Moby Trade loses over $1 million to private key leak

Another $1.47 million in assets were vulnerable as a result, but the whitehat blockchain security firm Seal911 successfully drained those funds to later be returned to the protocol once it was secured.

- "Moby Post-Mortem Report / Growth Plan", Moby Trade blog [archive]

- Moby Trade, Rekt [archive]

Orange Finance hacked

"The team is not sure what happened," wrote Orange Finance in a tweet announcing the hack, encouraging people to revoke contract approvals for the compromised addresses.

Orange Finance attempted to negotiate with the attacker via on-chain message, writing, "If you respond positively to our offer within 24 hours, we guarantee that no law enforcement agencies will be involved, and the matter will be treated as a white-hat hack."

Hengelo man arrested in alleged crypto pyramid scheme

Victims estimate that between €1.5 million and €4.5 million (~$1.54 million – $4.64 million) was stolen.

Man reports losing $100,000 to website spoofing a crypto exchange

The man contacted Canadian police, who told him the assets had been transferred out of the country and that they were unable to trace it.

NoOnes hacked for almost $8 million

Youssef emphasized that user funds were safe, which led to questioning from others on how that could be possible when nearly $8 million had been stolen. Youssef claimed he had reimbursed the stolen assets himself.

- Telegram post by zachxbt [archive]

- Tweet by Ray Youssef [archive]

Feed Every Gorilla hacked again for over $1 million

This time, the FEG project team blamed an issue with the project's bridge, which is a tool used to deposit and withdraw tokens from the project. An attacker was able to maliciously withdraw a large amount of FEG tokens via the flaw in the bridge, which they then sold off for around $1.07 million, tanking the FEG token price by 99% in the process. The bridge had been audited by the PeckShield blockchain security firm.

SEC fines Jump Crypto subsidiary $123 million

The SEC also found that Tai Mo Shan had acted as a statuary underwriter for the Terra sister token Luna, which was an unregistered security.

Tai Mo Shan agreed to the fine, and to a prohibition on future violations of securities laws.

- “Tai Mo Shan to Pay $123 Million for Negligently Misleading Investors About Stability of Terra USD”, U.S. Securities and Exchange Commission [archive]