Now, crypto investigator zachxbt thinks the same individual is indirectly responsible for a slew of compromised Twitter accounts that have then been used to promote crypto scams, including those of Beeple, DeeKay, and others. According to zachxbt, he has been selling access to a Twitter admin panel, which allows employee-level access to Twitter tools. This might explain how many of the accounts were compromised despite being protected by multi-factor authentication. According to zachxbt, "It's still unclear as to how Redman gained access to the panel to make elevated requests & reset passwords. As of now it appears the method stopped working".

Researcher zachxbt alleges that teenager who stole crypto worth $37 million in 2020 is responsible for a spate of crypto-related Twitter hacks

10% of Ethereum nodes at risk of being booted from cloud hosting provider

16% of all hosting nodes (a category that makes up 62% of all nodes by network type) are hosted with Hetzner — 10% of all nodes. If 10% of all Ethereum nodes being supported by one company sounds awfully centralized to you, wait til you hear that 30% run on Amazon services.

SudoRare NFT exchange rug pulls for $820,000

At least one of the scammer wallets interacted with the Kraken crypto exchange, a U.S.-based exchange that requires KYC, so it's possible that Kraken could help identify the scammers — though they've not made any public moves to do so.

- "NFT Exchange SudoRare Goes Dark After $820,000 Rug Pull", CryptoBriefing

- "SudoRare Pulled the Rug for $820,000. How Will Kraken Respond?", CryptoBriefing

Group charged for stealing over $4 million in transaction reversal scheme

The three men were charged with wire fraud, bank fraud, and identity theft charges, and face potential decades in prison if convicted.

- "Three Members Of Miami Crew Charged With Defrauding Banks And Cryptocurrency Exchange Of More Than $4 Million", U.S. Attorney's Office of the Southern District of New York

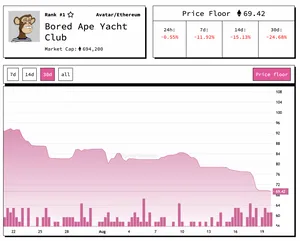

Bank run leaves BendDAO with 5 ETH and a bunch of NFTs they can't sell

BendDAO allows people to take out loans with their NFTs as collateral. However, if the floor price of those NFTs drops too far and the borrower doesn't pay back some of the loan to adjust its risk rating, other people can bid on the NFT.

The problem with this whole plan was revealed when lenders' confidence was shaken when it was reported that $5.3 million in Bored Apes were at risk of liquidation. Panicked users withdrew their assets from the platform, resulting in a bank run that drained the reserves to a low of 5 ETH (~$8,200). BendDAO had other assets, of course: the NFTs below the liquidation threshold. However, a lack of interested buyers willing to pay the minimum prices (95% of the collection floor price) left the project in a tough spot.

Since the extremely close brush with a liquidity crisis, the project has begun to consider a proposal that would reduce the threshold at which NFTs can be liquidated, reduce auction and liquidation protection periods, remove the 95% floor price bid requirement, and increase interest rates.

OpenSea's stale listing issue burns another collector

In this case, a person successfully sold their Pudgy Penguin NFT for 8.69 ETH a year ago ($27,500 at the time of sale). Those particular NFTs have been having a comeback lately, and so the collector bought the same NFT back — this time for 20 ETH ($31,500 at the time of sale). However, an old listing from their previous ownership was still active, and someone was able to snap up the NFT from them for only 9.89 ETH ($15,600) within minutes.

The collector's near-instantaneous $20,000 loss has a happy ending for them, though — the person who bought the NFT was willing to reverse the trade.

Someone buys a Bored Ape, gets scammed out of it two hours later

Hodlnaut seems to have lied about their Terra exposure

However, documents from the legal proceedings surrounding the now-underwater firm revealed that Hodlnaut had 317 million UST, which it liquidated at a loss when the previously dollar-pegged UST hit $0.85. In the filing, they wrote, "Due to the market's lack of liquidity, the average exit price of UST to USDC was around 42 cents on the dollar, resulting in realized losses to Hodlnaut Trading Ltd of about USD 189.7M. As a result, Hodlnaut's total debt to depositors of USD 500M became backed by realisable assets of around USD 315M as of 13 May 2022 due to the de-pegging event."

- "Hodlnaut Cuts Staff as Terra Exposure Is Revealed", Crypto Briefing

- Tweet by FatMan

Swyftx crypto exchange cuts 21% of staff

Swyftx had announced in June that it would be merging with trading platform Superhero in a $1.5 billion deal.

Sub-primate lending: $5.3 million in Bored Apes used as loan collateral are at risk of being liquidated

However, NFTs in general haven't been doing so hot lately, and the Bored Apes haven't been immune from the slump. As the Bored Apes collection floor price has decreased, more than 15% of the apes used as collateral for BendDAO loans are in the "danger zone" — close to being auctioned off. These 45 apes are valued at roughly $5.3 million. Liquidation could lead to cascading liquidations, as the auctions could themselves cause the floor price to decrease.

As Bennett Tomlin put it, "I hate that y'all somehow created a risk for cascading liquidations of JPEG backed loans".