Iris Energy's stock has plummeted to $1.66, down 93% from its $24.80 peak when the stock first began trading a year ago.

Iris Energy defaults on $100 million+ loan, unplugs miners

New York institutes two-year ban on new crypto-mining operations at fossil fuel plants

New York has been the home of some battles against crypto-miners who have set up shop at dormant fossil fuel plants. The Greenidge Bitcoin mining operation near Seneca Lake has been the locus of some particularly bitter battles against the industry: a dormant coal power plant that was converted to natural gas and devoted to Bitcoin mining in 2019, its permit renewals have been the focus of fierce protests. It will not be affected by this particular legislation, which only bans mining operations who have not already submitted applications for new or renewed permits.

- "New York Enacts 2-Year Ban on Some Crypto-Mining Operations", The New York Times

Genesis warns of bankruptcy if it can't raise $1 billion

The Wall Street Journal then reported that Genesis had been seeking a $1 billion emergency loan due to a "liquidity crunch due to certain illiquid assets on its balance sheet".

The halting of withdrawals from Genesis' lending business has already had major downstream impacts, as it is a major partner of other crypto lending services. Gemini and Coinhouse both followed Genesis in suspending withdrawals, as did other firms including Donut and GOPAX.

A Genesis bankruptcy would be a monumental event in crypto, with enormous downstream exposure.

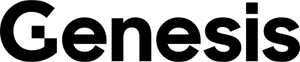

Grayscale Bitcoin Trust suffers due to FTX collapse and doubts over reserves

This was not helped by Grayscale's response to those in crypto who were pushing Grayscale to follow suit with some other crypto platforms and publish proof of reserves. Grayscale announced that "due to security concerns, we do not make such on-chain wallet information and confirmation information publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure". They did not elaborate on what these "security concerns" might be, and stoked fears in some that the company might not have the backing they ought to have.

Grayscale published a letter from Coinbase that basically said "we have Grayscale's assets, we promise", which did not seem to assuage the fears that have formed around centralized entities promising they have the assets they claim. This is understandable, given that FTX made similar promises, only to collapse.

Hoo Exchange vanishes

Since then, there has been little communication and a series of shady activities. According to HOO CEO Rexy Wang on Twitter on July 15, Hoo employee and former Binance head of security Fang Wenbin (known as "Top") "took advantage of his position at Hoo to delete the company system privately, causing everyone in the company to be unable to access the system, resulting in a temporary failure of the main domain name". Top replied to allege that, "Rexy himself has transferred most of the assets from the platform. Employee salaries and platform users cannot withdraw coins".

At some point after that, Wang made his Twitter private. Hoo's social media channels have been inactive. On November 18, the exchange website was replaced with a post that identified the "Hoo de facto controller", Xu Tong Hua, and said: "Currently all permissions for Hoo's wallet and website programs are controlled by Mr Xu, so please contact the official email if you have any questions."

Meanwhile, customers have been active on social media complaining about the apparent fraud, and some have formed an informal group pushing for legal action against Hoo.

Coinhouse suspends "savings accounts" due to Genesis suspension due to FTX collapse

Australian Securities Exchange scraps its $167 million, seven-year-long blockchain project

ASX will write off the AU$245–$255 million (US$164–$170M) they have poured into the project, and start again on designing a replacement for the CHESS system.

- "ASX kills its blockchain project, will write off $250 million", Financial Review

Class action lawsuit filed against celebrities who promoted FTX

The suit alleges that the celebrities violated the anti-touting provisions of securities laws by failing to disclose the nature, scope, and amount they were compensated to promote the platform.

Nigerian startup Nestcoin has nearly all funds locked in FTX, announces layoffs

Nestcoin had nearly all of the funds remaining from their $6.45 million funding round locked in FTX — approximately $4 million.

Gemini halts withdrawals from their lending service

The company said in a blog post that they were "working with the Genesis team" to restore withdrawals. Like Genesis, they tried to urge that the issue would not affect other Gemini products. However, a service outage that same day did little to strengthen trust in the company.