Founder of crypto investment scheme "IGObit" and the sham organization "World Sports Alliance" is convicted of wire fraud

- "President Of Sham United Nations Affiliate Convicted Of Cryptocurrency Scheme", U.S. Attorney’s Office, Southern District of New York

People briefly borrow Bored Ape NFTs to claim as much as $1.1 million in $APE tokens

People were somewhat split on whether this could be classed as a vulnerability in the $APE airdrop, since (as with many crypto hacks and scams) the person was operating completely within the rules set out in code.

Australian regulatory agency begins lawsuit against Facebook over failing to address scammy crypto ads

- "ACCC takes action over alleged misleading conduct by Meta for publishing scam celebrity crypto ads on Facebook", Australian Competition & Consumer Commission

Binance says it will stop operating in Ontario, for real this time, and admits they lied to investors

On March 16, Binance confirmed that they would actually stop servicing Ontario residents, for real this time. They also admitted to sending an email to investors on January 1 that said that they could no longer trade or onboard to the platform, despite not putting any such restriction in place.

- "Binance tells regulators it will cease operations in Ontario... for real this time", Cointelegraph

- "Binance is not registered in Ontario", Ontario Securities Commission

Discord hack targeting Rare Bears NFT project nets attacker $800,000

Not only did the attackers post a fake mint link, they took steps to prevent the project from thwarting their attack by banning other members and removing user rights that would have allowed other project members to delete the fake links. They also added a bot to the server that locked channels so people couldn't send warnings that the links were fake.

The Rare Bears team did eventually regain access and secured their Discord server. In an apology posted on their Twitter page, they addressed the multiple security breaches that Rare Bears have faced to date, and said they had "stepped up" and would be having a firm audit their project.

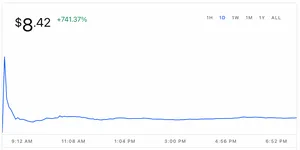

Bored Ape Yacht Club launches their new ApeCoin, which immediately tanks in price

The $APE price briefly soared to around $40 shortly after launch, before crashing precipitously to around $8.50 not long after, presumably as people cashed out their free money. Even many cryptocurrency enthusiasts were nonplussed by the launch, with many describing it as a "money grab" or an attempt to enrich the founders, which apparently is a bad thing (despite many crypto projects openly doing the same). One angry Redditor wrote, "Owners of Bored Ape NFTs were given the coin first(very rich people), then it was sold to the normies who got FOMO and pumped the price, then it crashed. Yet again, leaving regular people holding bags of pure garbage while the coin pushers wave bye-bye from their lambos."

- "Everybody Is Mad About 'ApeCoin'", Vice

- "This APE fiasco is just about getting the founders rich" from r/CryptoCurrency

- Tweet by kevwuzy

Winamp joins LimeWire in the emerging "legacy software comes back from the dead to do NFTs" trope

Original Winamp skin, which they say will "be the base Artwork for all your derivative needs" (attribution)

Original Winamp skin, which they say will "be the base Artwork for all your derivative needs" (attribution)Official Formula 1 blockchain game suddenly shuts down

NFTBOOKS enters the race to see who can remake DRM the worst

Fortunately there doesn't actually appear to be much to the project yet — actually creating a platform and an app to allow people to borrow books doesn't come until the fifth and sixth stages of their roadmap. The project is currently on the fourth step, and has been focusing their attentions on things like "marketing campaign" (stage 1), "aggressive marketing rollout" (stage 2), and "extreme marketing campaign" (stage 3). The stage 3 "extreme marketing campaign" also came with a "website relaunch", which we have to thank for one of the most outrageous pie charts I have ever seen (pictured) (which was later determined to have been a stock photo of a pie chart where they'd just changed the numbers). Perhaps they should focus some of their marketing efforts on coming up with answers to the simplest of questions that they should probably expect from authors — the type of people they're claiming to help.

Hundred Finance and Agave Finance are both exploited for a collective $12 million

Hundred and Agave were the second and third defi protocols targeted by flash loan attacks that same day, with Deus Finance losing more than $3 million to hackers using the same class of exploit.

![A rendering of a blue and white F1 racecar, hovering above a black triangular plastic base that says "Tiberon [sic] Car"](https://primary-cdn.web3isgoinggreat.com/entryImages/resized/f1deltatime_300.webp)