OneCoin was a Bulgarian ponzi scheme in which investors bought packages of "tokens" with which they would supposedly "mine" cryptocurrency. Despite advertising as a decentralized cryptocurrency, OneCoin in reality was centralized on the company's servers. The scheme attracted around $4 billion in investments since its creation in 2014, and several people associated with the project have pled guilty to money laundering and fraud charges.

"Cryptoqueen" Ruja Ignatova added to Europol's most wanted list in connection to OneCoin ponzi scheme

Coinbase adds new language regarding bankruptcy to its latest quarterly report

This serves as a stark reminder to users who keep their cryptocurrency on exchanges, that although it is often a more user-friendly way to keep crypto (compared to self-custodying), it exposes users to risk like this.

Some members of the crypto community expressed shock, with Swan Bitcoin CEO Cory Klippsten tweeting, "Is this real?!?"

Former footballer Michael Owen claims his NFTs "will be the first ever that can't lose their initial value"

It appeared that Owen might have meant that there would be a lower bound on resale price of the NFTs, which is neither a new concept in NFTs (see Kaiju Kongz or Rich Bulls Club), nor does it mean the NFTs "can't lose their initial value". It just means that when the NFTs do lose their initial value, collectors can't recoup even a portion of their investment.

- "Michael Owen mocked after making bold claim that his NFTs can't lose value", Manchester Evening News

G.O.A.T. token developer rug pulls for $260,000

The remaining project developers have tried to remain positive and restore faith in the community, accusing the developer who sold of "gluttony" and "greed". The project also implemented a steep 50% tax on remaining holders to discourage them from trying to sell.

Founder of popular Azuki project admits to past rug pulls

This news came as a shock to many lovers of Azuki NFTs, pricey NFTs which regularly trade for 20–30 ETH (~$45,000–$70,000). Azuki is not without its own controversies, recently facing accusations of insider trading.

- "A Builder’s Journey", by Zagabond

- Tweet by zachxbt

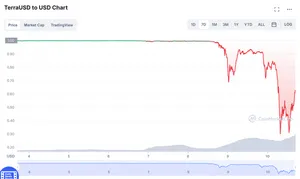

TerraUSD (UST) stablecoin dramatically loses its peg

The incentives that should keep TerraUSD trading at $1 have been put to the test lately, with a combination of spiraling cryptocurrency prices across the board and some apparent large sell-offs by those holding UST. The coin dipped down to $0.992 on May 7 before some large buys returned it close to its peg. It dipped again by a smaller amount the following day, reaching a low of around $0.994. These values may seem like small changes on the micro scale, but when major stablecoins diverge from their peg by even fractions of a cent they have major effects throughout the cryptocurrency ecosystem.

On May 9, UST saw its most extreme de-peg, plunging to $0.95, then again to $0.84 later that day, despite Luna Foundation Guard liquidating $1.3 billion in Bitcoin reserves to try to restore the peg.

Do Kwon, cofounder of Terraform Labs, initially seemed to be doing his best to portray confidence on Twitter by tweeting things that give the exact opposite impression. "If yall girls are gonna fud, try to do it during my waking hours pls," he wrote on May 7. "You could listen to [crypto Twitter] influensooors about UST depegging for the 69th time. Or you could remember they're all now poor, and go for a run instead", he tweeted, somewhat blithely acknowledging UST's repeated history of losing its peg. His tweets seemed to take a more serious turn beginning the evening of May 8, as the situation grew more dire.

Attacker steals $3 million from Fortress Protocol

The exploit caused the $FTS token to drop 42%. The creators of Fortress urged people not to supply any assets to the pool as the attack was ongoing, and tweeted "we need the support of all of our partners and key organizations in the community to assist and try to freeze and bring back the funds!"

Cashera makes off with $90,000

Despite all this, the project deployer suddenly minted 23 million CSR tokens, which they swapped for almost $90,000 in other assets, crashing the token value in the process by about 70%. The development team also took the project website offline.

Hunter defi project rug pulls for $1.2 million

The rug pull was first noticed by CertiK, a blockchain security firm that had also audited the project. "We pointed out these major centralization issues in their audit," CertiK wrote on Twitter.

Fury of the Fur rug pulls for $300,000

However, the NFT launch went poorly — fewer than 2,800 NFTs were minted out of the total supply of 9,671 NFTs. The project tried to relaunch but failed to drum up much more interest, so the creators apparently decided to call it quits — while keeping the money, of course. The project founder left a long message to the community, in which they said that they would be shutting the project and spoke at length about how difficult it had been for them.