Mango Markets posted on Twitter to urge users not to deposit into the project, and asked the hacker to contact them "to discuss a bug bounty". The hacker had their own plans, instead submitting a governance proposal in which they would return $46 million of the stolen funds (keeping $70 million) in exchange for a promise that the protocol would not try to freeze the assets or pursue criminal charges. The hacker then used their 32 million governance tokens to vote in support, but ultimately were not able to get the proposal to pass. A different proposal with largely the same terms, but which left the attacker with only $47 million of the stolen funds, passed shortly after.

Mango Markets suffers loss of more than $116 million

Attacker makes off with $1.1 million after successful governance attack on the Audius web3 music platform

Audius halted the token and smart contracts while they patched the bug, and brought the network back online shortly afterward. The attacker had found and exploited a vulnerability in the way the contracts were written which allowed them to rewrite the governance voting rules and delegate 10 trillion AUDIO tokens to themselves for voting purposes. They then used those tokens to pass the malicious proposal. The contracts had been audited by OpenZeppelin and Kudelski, but neither group caught the vulnerability. Audius stated that a plan for dealing with the loss of community funds was still under discussion.

Terra blockchain is halted after token crash increases threat of governance attacks

Terra only announced this after halting the network, giving their users no opportunity to try to withdraw funds. They have made no announcement about whether or when they intend to bring the network back online, although it seems safe to assume that the enormous loss of confidence in Terra would make any restart short-lived.

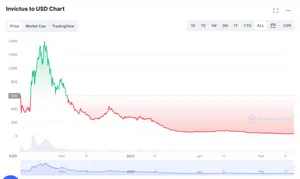

Invictus DAO whales quickly vote to shutter the project in its first ever community vote, leaving most others with huge losses

However, although the project enjoyed a spike in price in November, the token has bled value since then. On March 9, the project leaders began a conversation about team salaries, where they also floated the idea of redeeming the treasury and closing the project. On March 11 they began a vote, which lasted only three days, and allowed members of the DAO to vote on whether the project should close and distribute treasury funds to participants. Much like the Wonderland vote in late January, a relatively small number of whales with a large share of the votes (who bought in early and still stood to make money on the project) were able to pass the vote to close the project, despite a majority of voters selecting to keep the project going. Furthermore, because the Invictus tokens used for voting also themselves hold the value, some people were unable to vote in the poll because their tokens were locked up in lending platforms where they had used them as collateral. Many participants in the project who haven't been actively watching the governance page likely don't even know the vote happened.

Some members of the project wrote on Discord that they felt rugged, with one even speculating that the project had been so eager to implement voting so they could pass a "community" vote to close the project and make off with a profit without damaging their reputations or potentially facing lawsuits. Various members of the project Discord shared how much they had lost: one person said they were down $20,000, another was down $75,000, and a third person reported losing $400,000. One person asked "who else is in the 6 figure loss club" and received three agreement emoji reactions; another person said they'd lost a year's salary. Some people already opted to try to sell their tokens early, worrying that the project leaders might make off with the treasury and not allow people to redeem their $IN; others waited in hopes of the redemption price being higher than the current token price; and some even suggested buying more $IN in hopes that they could make a profit if the redemption price is higher than the current price.

- [RFC] Allocate Funds for Team / Operational Expenses + Third Option on Invictus DAO forums

- [INIP] Allocate Funds for Team / Operational Expenses + Redemption on Invictus DAO forums