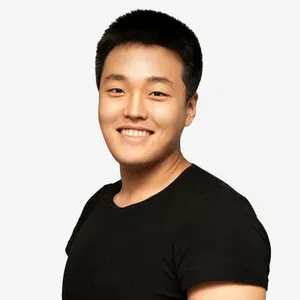

Kwon and the others named in the warrant are currently in Singapore. In June, Korea banned current and former Terraform Labs employees from leaving the country, and in July Korean authorities raided multiple exchanges in connection to their investigation.

South Korea issues arrest warrant for Terra founder Do Kwon

Korean authorities raid seven cryptocurrency exchanges in relation to Terra investigation

Terra decides to release "Terra 2.0", because apparently the way to fix a crypto catastrophe is with more crypto

Billy Markus, one of the original creators of the Dogecoin cryptocurrency (both of whom have since left the project), tweeted, "luna 2.0 will show the world just how truly dumb crypto gamblers really are".

Class action lawsuits filed against Terra founders after crypto collapse

Another Korean group, calling themselves "Victims of Luna, UST coins", has amassed 1,500 members and reportedly plans to file a lawsuit against Kwon and Terraform Labs' other cofounder, Shin Hyun-Seong (who is also known as Daniel Shin, and is no longer with Terraform Labs).

This development may be particularly inconvenient for Kwon and Shin, given Terra's legal team quit the company the previous day.

On June 17, another investor filed a separate lawsuit against Terraform Labs, Kwon, and various others in a US court.

CoinDesk reports that Terra's Do Kwon was behind another failed algorithmic stablecoin project

Do Kwon has never disclosed his involvement with this failed project. CoinDesk wrote that although their "default position is to respect the privacy of pseudonymous actors with established reputations under their well-known handles unless there is an overwhelming public interest in revealing their real-world identities", there was now "such public interest as Kwon's UST stablecoin death spirals, wreaking havoc across the broader cryptocurrency market. Amid this precarious situation, investors deserve to know that UST was not Kwon's sole attempt at making an algorithmic stablecoin work." It was not made clear in the article when CoinDesk first learned of Kwon's connection to Basis Cash, though the authors later stated they'd learned of it the night before they published.